SA100, in other words, annual self-assessment tax return and is commonly known as the personal tax return is your major compliance work to carry out as a sole trader.

This article aims to help you in having a basic understanding of the concept and to address the frequently asked questions.

Who needs to file SA100 Tax Return?

- Self-Employed Individuals: All sole traders dealing in goods or services in their own capacity (not as a Company),

- Directors of a limited company,

- All individuals having a gross income of over £100,000 in a year,

- Individuals receiving income from savings, investment or property,

- Individuals having a foreign income,

- Any other category of individuals who have received a letter from HMRC for filing SA100 return

- Other special categories? contact us to find out more.

You don`t need to file SA100 if your only income is through being on payroll unless you`re on dual-income, both on payroll and self-employed. Then, HMRC expects from you to file your SA100 on time by indicating the exact number on your P60.

What do you need to make ready for the SA100 form?

The form shall contain the Self-Assessment UTR, personal details of the assessee such as date of birth, national insurance number, home address, etc. It should also contain comprehensive particulars of the total income from various sources such as interests, salaries, dividends, self- employment income, income from rent, the sale of the property, etc. in the prescribed format as per HMRC guidelines. You may also need to fill out various supplementary pages such as:

- Self-Assessment Tax Form shall contain the UTR (Unique Tax Reference),

- Personal details, such as date of birth, national insurance number, home address, etc.

- It should also contain the full scale of the total income from various sources such as interests, salaries, dividends, self- employment income, income from rent, the sale of a property, etc. in the prescribed format as per HMRC guidelines.

- You may also need to fill out various supplementary pages such as:

- Employees or Company Directors – SA102

- Self-Employment – SA103S or SA103F

- Business Partnerships – SA104S or SA104F

- UK Property Income – SA105

- Foreign Income or Gains – SA106

- Capital Gains – SA108

- Non-UK residents or Dual Residents – SA109

When to submit the SA100 return?

The deadline for paper forms for the period 6 April 2018 to 5 April 2019 is 31st October 2019, however, HMRC offers extra time until 31st January 2020 if you prefer to submit it online.

Last but not least, try to remember to make your self-assessment tax return payment on the same day of submission before the deadline.

Self-Assessment Tax Return penalties 2019 are starting from £100 for a 3 months’ delay. The daily penalty rate is £10! So, you might as well end up paying fortunes just for delaying a couple of weeks. Estimate your penalty (here).

Penalties and Deadlines for Self-Assessment Tax Return 2019:

We strongly recommend you don`t leave your registration and self-assessment tax return payment to the last minute. There`s a lot of things on HMRC`s plate due to Brexit and the brand-new initiative called MTD for VAT.

| Self-Assessment Registration | Deadline for return and payment |

|---|---|

| Register if you`re sole-trader or self-employed | 5 October 2019 |

| Paper Tax Return | Midnight 31 October 2019 |

| Online Tax Return | Midnight 31 January 2020 |

| Self-Assessment Tax Payment | Midnight 31 January 2020 |

Personal Allowances in 2019

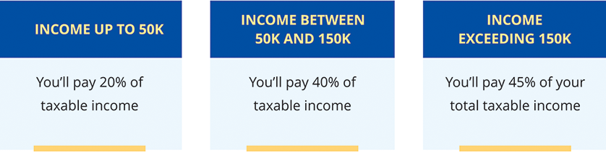

Personal Allowances from your taxable income has risen from £11,850 to £12,500 as of April 2019. Take a look at the table below, see what percentage you should pay as tax until January 2020 for your personal tax return due date 2019;

Note: You start losing £1 of your personal allowance for every £2 you earn above £100k

How quickly can I get this filed with Online Account Filing?

We have a proficient team who is an expert in handling the whole process of personal tax return related compliance works in about 2-3 business days once you submit all the necessary data. All we need is the relevant details that are to be submitted in due course, simple and easy-to-understand spreadsheet.

More questions?

Online Account Filing is at your service, we are just an email or a phone call away to assist you further with the detailed information on the subject.

We encourage the readers to contact us for any queries.